ABeam Consulting shares insight on Thailand’s telehealth and insurance sectors amidst the rise of AI and the aging population.

ABeam Consulting shares insight on Thailand’s telehealth and insurance sectors amidst the rise of AI and the aging population.

In the modern era, it’s rare for a single industry to stand alone. Markets are typically established through the mutual interaction of multiple industries. Particularly, industries like telehealth[1] not only influence the healthcare sector but also impact seemingly unrelated sectors. Those who have recognized this phenomenon are exploring collaborations, making telehealth one of the most observed industries. To begin with, improved access to telehealth services has enjoyed continued supportive investment from the Thai government since the COVID-19 pandemic began. From the initial purpose of managing the care and home isolation for COVID-19 patients in 2020, telehealth services have expanded to cover 42 common diseases for Thai citizens both within the country and abroad. Accordingly, large private hospitals in Thailand have started utilizing online channels for routine services, with several new telemedical startups entering the scene.

The growth of telehealth service adoption in Thailand also sees a marked surge in both user numbers and expenditure per user. This is especially the case for patients who wish to manage their chronic conditions through IoT (Internet of Things) devices from the comfort of their homes. The willingness to pay for online doctor consultations is also trending upward.

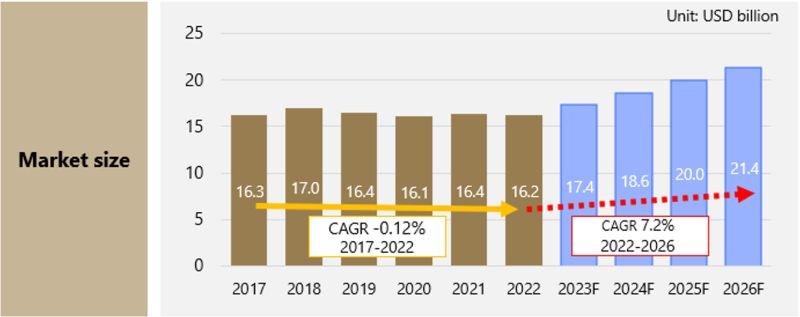

The factors underlying the telehealth sector’s growth also play a major role in the insurance industry. The country has almost transitioned from an aging to an aged society, with 14% of the population being 65+ years old. The rising expenditure (5-8% annually) in Thailand’s aging society and the advances in AI technology contribute significantly to the recovery of the health insurance market, as well as the life insurance market overall.

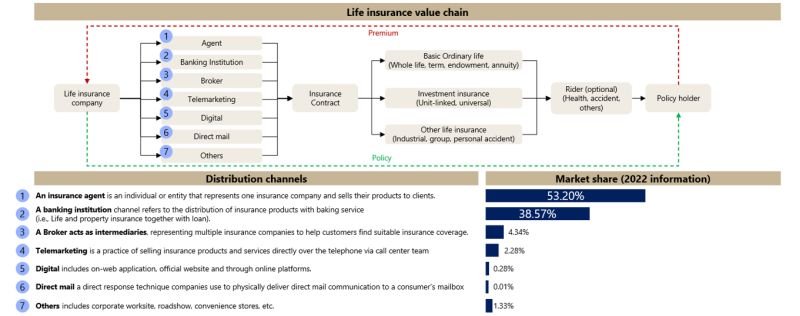

The use of AI in healthcare is also supported by the government, as it is actively formulating Thailand’s National Artificial Intelligence Strategy Plan to enhance the nation’s economy and people’s well-being by 2027. Telehealth could also have the possibility to improve the accessibility of patients to doctors and alleviate the rise in health expenditure. In the meantime, life insurance distribution channels are still traditional, and various online channels are not being used by customers to compare insurance offerings. The network of insurance agents and distribution through big commercial banks remains prevalent in the country. However, these distribution channels would possibly be transformed by new entrants, initiatives, or regulatory conditions.

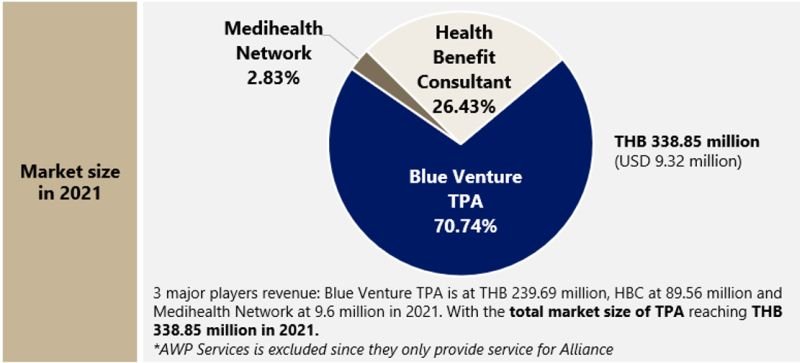

Digital technology is also key to the TPA (third-party administrator) health insurance market. TPA players provide medical management, claim processing administration, intelligent system and reporting. Currently, there are only a few TPA companies operating in Thailand, with Blue Venture TPA dominating the market share. In some countries, TPA provides managed care services such as telehealth. For instance, in Singapore, the government has introduced regulations to adjust the service billing format of TPA services, which would be subtly altering the attractiveness of TPA market. If the Thai government were to adopt a similar policy, the TPA market might potentially experience a temporary dip.

The non-life insurance market is also expected to group at 5.7% CAGR until 2026, primarily driven by increasing demands from compulsory insurance of motor vehicles, EV battery insurance, aesthetic insurance (as a consequence of cosmetic procedures), and insurance against national disaster events. The non-life insurance landscape is highly competitive, with no clear winner monopolizing. Companies tend to specialize in different business categories, such as motor, marine, fire, and property and to integrate telehealth services into those specialized insurance Even though non-life insurance products in Thailand are majorly sold through insurance brokerage firms, the digital market is showing promising growth as an increasing number of users prefer online channels.

As demonstrated by developments in sectors such as healthcare and electric vehicles (EVs), we live now in an era where industry players are transcending traditional boundaries to generate innovative business ideas. It is essential to have a comprehensive understanding of trends and technology applications across various industries to accurately predict future directions. For realizing new business creation, ABeam Consulting could support clients from business planning to execution with a balanced approach, which includes strategic planning, business process re-engineering, organization reformation, data analytical solution, and IT system integration.

[1] Telehealth is defineof services. In other words, it’s called as telemedicine.