ABeam Consulting shares lessons learned from Japanese companies: Seven pitfalls hindering improvements in effective ROIC management, and how to avoid them

ABeam Consulting shares lessons learned from Japanese companies: Seven pitfalls hindering improvements in effective ROIC management, and how to avoid them

ROIC (Return on invested capital), an indicator of a company’s “earning power,” has gained attention in recent years due to the demand for capital efficiency in capital markets. However, misuse can be counterproductive, especially for Japanese companies with siloed frontlines. Business units can appear superficially compliant, leading only to increased management costs and “more labor, less profit.”

In this Insight article, ABeam Consulting identifies seven pitfalls hindering effective ROIC management and corresponding solutions to avoid them.

Why consider ROIC now?

ROIC-based management has enjoyed a renewed surge in interest among Japanese companies, as it facilitates side-by-side comparison of yields on invested capital for each business category.

In this view, there are four measures to increase corporate value: increase profits without additional capital investment, capitalize on businesses that generate profits in line with additional capital invested, withdraw investments from businesses that cannot generate profitability, and achieve lower cost of capital.

Points to note when utilizing ROIC

ROIC can be a double-edged sword for Japanese companies where frontline business units (BUs) are siloed, potentially leading to austerity measures and hindering scale growth. It can also leave inefficiencies unaddressed, weaken control, and cause delays in investment, including digital transformation. Additionally, mergers and acquisitions can cause the individual BUs – already disconnected – to shift responsibility onto one another.

The seven pitfalls hindering improvements in effective ROIC management and how to avoid them

Many Japanese companies struggle with ROIC management, as superficial compliance on paper leads to increased costs and labor. Without sufficient care, corporate value may suffer and the company’s raison d’être unfulfilled.

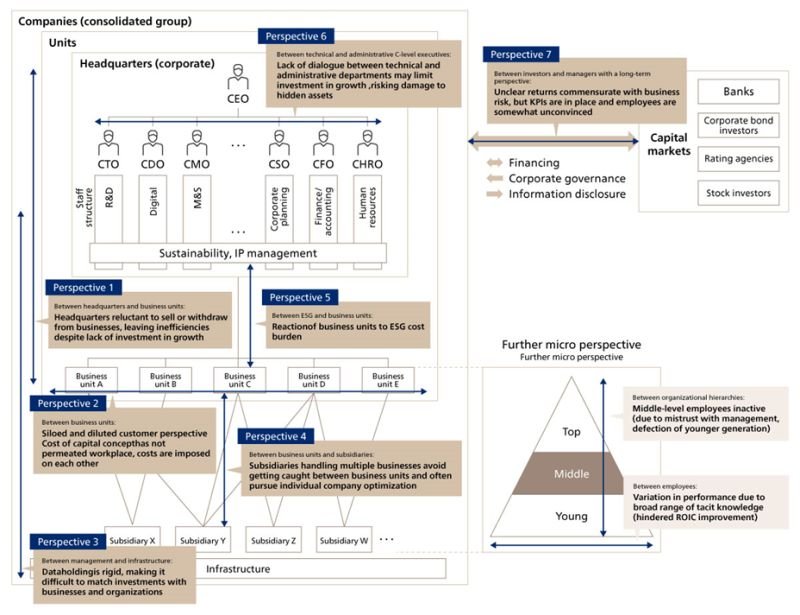

Specifically, there are seven potential “pitfalls” (Figure 1) that undermine corporate value in the course of organizational management, which are as follows:

Figure 1 Seven “pitfalls” hindering improvements in effective ROIC management (the silo trap that undermines Japanese companies)

Pitfall 1: Between Headquarters and Business Units

Headquarters are responsible for founding BUs and are reluctant to sell or withdraw from them. According to ABeam Consulting’s Evolving ROIC Management Survey (hereafter “our survey”), companies with low market price-to-book ratios (P/B ratio below 1.3) are more reluctant to exit businesses. In such a situation, management costs will rise as inefficiencies remain unaddressed.

To avoid this pitfall, it is important to manage the business portfolio with technology, organizational capabilities, and human resources to stimulate objective discussions regarding investment vs. structural reform/exit. Where cost cutting is necessary, HQs should start by cutting their own costs before mandating BUs to improve their ROIC.

Pitfall 2: Between Business Units

Japanese companies often have strong BUs that are siloed and, at times, compete for the same customers. According to our survey, “companies with room for improvement” narrow down their KPIs in line with their business characteristics when compared to “blue-chip companies,” reinforcing the disconnect between BUs.

To avoid this pitfall, KPIs should be constructed from the customer value perspective to extract the full potential of each business unit synergistically. Identify the Key Buying Factor (KBF) in the value chain, determine whether those factors are stagnant, and pinpoint what is causing the blockage. The relative weight, the “what,” and the “who” of KPIs can be made clear based on this knowledge. Responsibilities for the balance sheet are not only profit-and-loss but can also encourage long-term thinking around assets and investment.

Pitfall 3: Between Management and Infrastructure

Data is often held in a rigid structure, making it difficult to flexibly reinforce businesses and organizations with M&As and other investments. There are many Japanese companies whose code system differs from unit to unit. They are reluctant to make the necessary investment in data infrastructure to track ROIC by business category or on a consolidated basis. Our survey shows that “companies with room for improvement” tend to invest only sparingly in data infrastructure compared to “blue-chip companies.”

To avoid this pitfall, data infrastructure needs to accommodate consolidated business management. Data integration tiers can be established to integrate scattered data across the company using existing IT assets. However, sudden large-scale ERP modifications run the risk of major rework. Companies may start with spreadsheet compilation, RPA, and large-scale modifications in conjunction with periodic ERP updates.

Pitfall 4: Between Business Unit and Subsidiaries

Subsidiaries that handle multiple businesses tend to avoid getting caught in dilemmas between BUs and often pursue individual company optimization. As a result, consolidated groups have common inventory holdings in subsidiaries. This could increase working capital, but because resources are held at subsidiaries, BUs may be compelled to outsource even when subsidiary capacity is available.

To avoid this pitfall, there needs to be a reallocation of functions between BUs and subsidiaries. This will help prevent individual optimization, organize flow distribution, and make the structure of business consolidation easier to understand.

Pitfall 5: Between ESG and Business Units

BUs are often incentivized to oppose ESG due to the cost burden, reducing the effectiveness of corporate-wide ESG activities.

To avoid this pitfall, the cost burden of ESG must be reduced by lowering the hurdle rate to gain buy-in from BUs. The fairness of doing so can be convincingly communicated using data-driven visualization of ESG value to the BU, ensuring objectivity and transparency.

Pitfall 6: Between Technical and Administrative C-Level Executives

More dialogue needs to be established between technical CTOs, CDOs, administrative CEOs, and CFOs to avoid unnecessarily curbing investments in R&D, DX, and growth.

To avoid this pitfall, a technology resource inventory (a strategic technology management approach) is beneficial for establishing a common language among C-level executives about technology. This allows the assessment of priorities and the necessary scale of technology investment to ensure business contribution. A technology tree can structure this from a customer value perspective.

Pitfall 7: Between Investors and Managers

Investors find the return commensurate with business risk unclear. Managers then struggle to explain when and how much an investment will provide returns and risks. Without appropriate KPIs and employee buy-in, managers with a long-term perspective tend to find themselves in a dilemma. In such cases, even if individual KPIs are enhanced, the traps of “partial optimization” and “general agreement, specific disagreement” are common, and company-wide KPIs (ROIC) rarely increase.

To avoid this pitfall, investors need to clarify returns vs. business risk, including the type and amount of investment, why, when it is likely to be recovered, and the path to cash generation. It should be made clear that different BUs in the same corporate group earn different amounts of money. This view of a portfolio should relate to both the profit-and-loss perspective and the balance sheet perspective, which should guide companies to prioritize decisions congruent with the corporate philosophy and purpose.

Implications from ROIC Management

ROIC management is not only relevant to the CFO’s agenda. It is also a hub connecting the entire company (Figure 2) and concerns all C-level executives. Ultimately, it could be used as a guide to eliminate silos in Japanese companies.

Figure 2 ROIC management, an evolving hub that connects CFOs with other C-level executives

With an extensive track record in the Japanese context, ABeam Consulting will continue to apply its expertise to support the realization of rapid and reliable ROIC management by providing consulting services in line with the different objectives and stages of individual companies.