ABeam Consulting shares insight on Thailand’s pharmaceutical sectors’ opportunities, challenges, and entry approaches for New Entrants

ABeam Consulting shares insight on Thailand’s pharmaceutical sectors’ opportunities, challenges, and entry approaches for New Entrants

Thailand’s pharmaceutical and healthcare market is experiencing rapid growth fueled by government policies, increasing healthcare demand, and advancements in medical technology. The country’s healthcare industry has emerged as a major economic driver, offering significant opportunities for both domestic and international investors. The Thai government has actively promoted policies to enhance healthcare accessibility, reduce costs, and establish the country as a medical hub in Southeast Asia as Thailand continues to expand its pharmaceutical and healthcare infrastructure. This whitepaper provides an analysis of Thailand’s pharmaceutical and healthcare market, exploring key growth drivers, government support mechanisms, supply chain dynamics, and entry options, including the role of Contract Sales Organizations (CSOs) for businesses looking to establish a foothold in this lucrative industry.

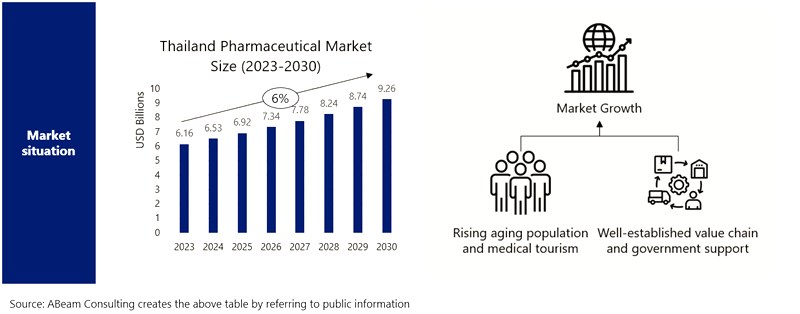

The Thai pharmaceutical market is expected to grow to 6.92 billion USD by 2025, supported by policies promoting generic drugs and cost reduction in healthcare [Fig. 1]. Government initiatives encourage the use of affordable generic drugs to reduce healthcare costs. Digital health technologies, such as telemedicine and e-pharmacies, are making healthcare more accessible and efficient.

Fig. 1 – Thailand Pharmaceutical Market Size

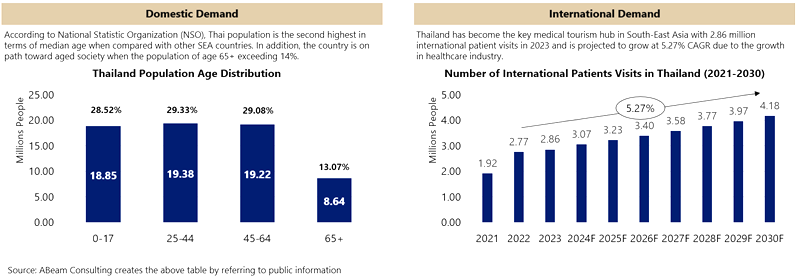

This growth is driven by both demand and supply within the country [Fig. 1]. For the demand side, Thailand is transitioning into an aged society, with 13.07% of the population aged 65+ by 2023 [Fig. 2]. Thailand is also a key medical tourism hub, with 2.86 million international patient visits in 2023, projected to grow at 5.27% CAGR. This means that it is beneficial for new investors to focus on promoting products that are catering towards chronic diseases or other popular diseases that tourists visit Thailand for.

Fig. 2 – Thailand Healthcare Demand Drivers

For the supply side, Thailand presents a well-established healthcare value chain comprising international pharmaceutical and medical device manufacturers, government manufacturers, wholesalers, and contract sales organizations. This robust infrastructure supports industry growth and strengthens Thailand’s appeal as a medical tourism destination. It also provides new players with ready access to established distribution networks, regulatory support, and streamlined commercialization pathways, reducing barriers to market entry. However, there is a potential threat from government manufacturers, which produce and sell high-demand generic drugs at low prices. This could limit market opportunities for private pharmaceutical companies, particularly those offering similar products.

Fig. 3 – Thailand Healthcare Supply Drivers

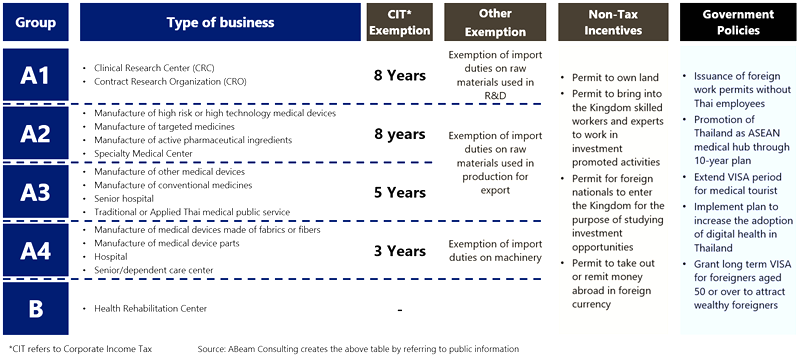

In Addition, the Thai government’s incentives are designed to attract high-value investments and strengthen the country’s healthcare ecosystem. These policies aim to reduce reliance on imports, enhance local manufacturing capabilities, and foster a self-sustaining healthcare industry. Additionally, by supporting senior care facilities and hospitals, the government is addressing the needs of an aging population while attracting wealthy foreigners aged 50 or over with long-term VISA permits. These strategic initiatives position Thailand as a competitive healthcare hub, driving economic growth while ensuring accessible, high-quality medical services for its population.

Fig. 4 – Thai Government Support for Healthcare Industry

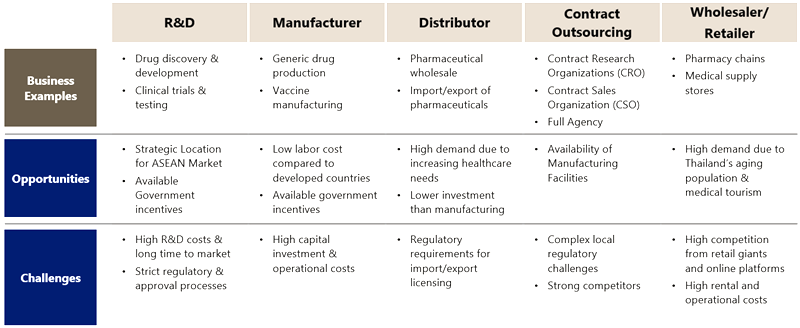

With such an attractive market, foreign pharmaceutical companies entering Thailand must consider investment costs, as manufacturing and healthcare services require significant capital, while distribution and outsourcing offer lower-cost entry. Market demand and competition should be assessed, as Thailand’s aging population drives growth in healthcare and biopharmaceuticals, while retail and distribution face intense rivalry. Government incentives support R&D and manufacturing. Evaluating these factors ensures a strategic and successful market entry [Fig. 5].

Fig. 5 Types of Business in Thai Pharmaceutical Market

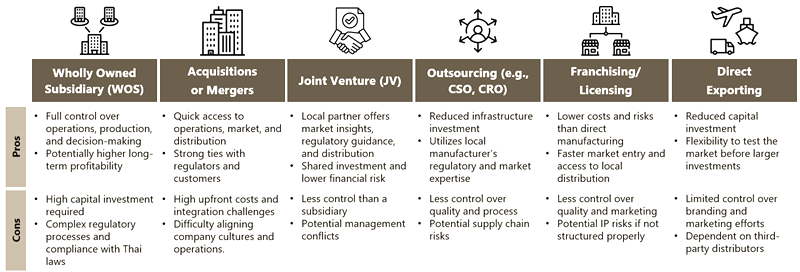

Companies have many market entry strategies, including establishing wholly owned subsidiaries, M&A, joint ventures, forming partnerships, franchising, and exporting [Fig. 6]. Companies must consider investment costs, control, regulatory complexity, market access, risk exposure, and scalability. Higher investment may grant greater control, while lower-cost options often involve reliance on partners or third parties. Market access speed depends on whether companies build networks or leverage existing ones. Risk factors include financial exposure, supply chain challenges, and IP protection. Lastly, scalability ensures long-term growth aligns with the chosen strategy.

Fig. 6 – Market Entry Strategy

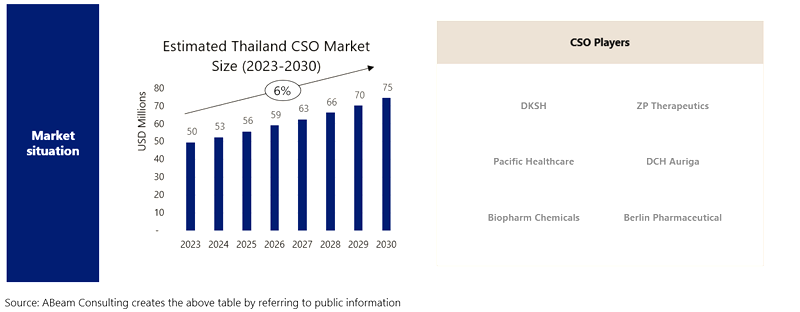

As an example, one commonly used option for pharmaceutical companies to enter the market is through a partnership with a contract sales organization (CSO). CSOs typically provide services such as sales and distribution, making them a strategic choice for pharmaceutical companies entering the market. Various pharmaceutical companies partnered with CSO to help optimize sales and after-sales processes. The Thai CSO market is a well-established and growing market. It is projected to grow at 6% CAGR, reaching 75 million USD by 2030 [Fig. 7]. Players such as DKSH and Zuellig Pharma are dominating the market with strong sales teams, wide connections, and established logistics networks, but there are also local players such as Biopharm and Berlin Pharma that may specialize in niche products.

Fig. 7 – Thailand CSO Market

To wrap up, Thailand’s healthcare and pharmaceutical sector offers a lucrative and well-supported business environment for new entrants. Furthermore, there are various government incentives and investment options available. The key success factor in entering the Thai pharmaceutical market is strategically utilizing the existing benefits and resources unique to Thailand. This could possibly be done by utilizing a robust supply chain, outsourcing key functions through CSOs, and tapping into medical tourism and aging population trends; businesses can successfully establish a strong and sustainable presence in Thailand’s thriving healthcare market.